Little Known Facts About Pvm Accounting.

Little Known Facts About Pvm Accounting.

Blog Article

Fascination About Pvm Accounting

Table of ContentsFascination About Pvm AccountingThe Buzz on Pvm AccountingRumored Buzz on Pvm AccountingSome Known Details About Pvm Accounting The Greatest Guide To Pvm AccountingTop Guidelines Of Pvm AccountingTop Guidelines Of Pvm AccountingFacts About Pvm Accounting Revealed

One of the key reasons for applying bookkeeping in building tasks is the need for financial control and monitoring. Audit systems offer real-time understandings into task expenses, earnings, and success, making it possible for task managers to immediately identify possible issues and take rehabilitative actions.

Accountancy systems make it possible for business to monitor cash money circulations in real-time, making sure enough funds are available to cover expenditures and meet monetary obligations. Efficient capital management assists protect against liquidity crises and keeps the task on track. https://www.goodreads.com/user/show/178444656-leonel-centeno. Construction jobs go through different economic mandates and coverage needs. Appropriate bookkeeping makes sure that all economic transactions are tape-recorded accurately which the task abides by accounting standards and contractual contracts.

Unknown Facts About Pvm Accounting

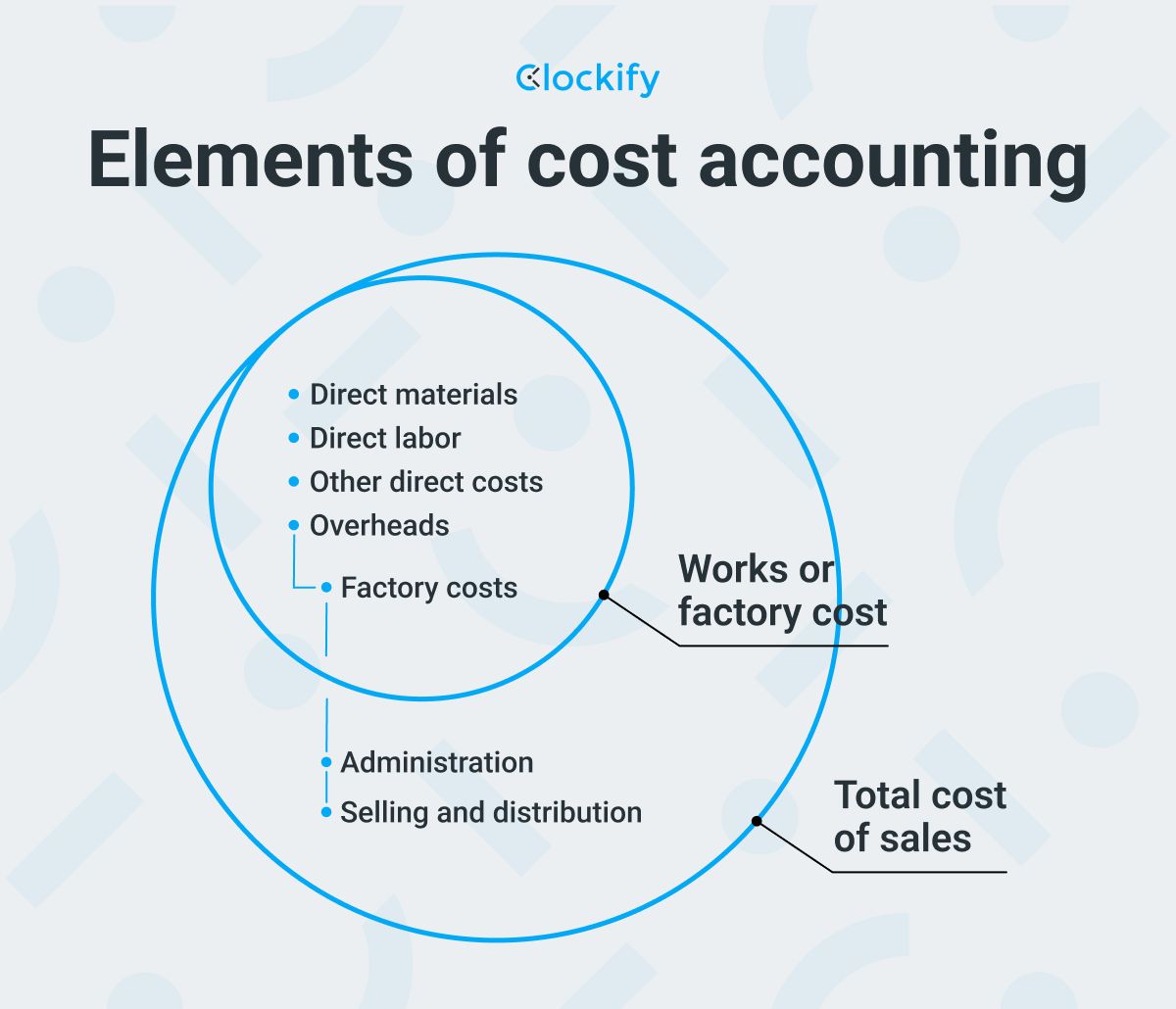

This decreases waste and enhances task effectiveness. To much better recognize the relevance of audit in building and construction, it's additionally necessary to compare construction monitoring audit and job management bookkeeping. mostly concentrates on the financial elements of the construction firm all at once. It manages overall financial control, budgeting, capital management, and economic coverage for the whole organization.

It focuses on the monetary aspects of specific construction projects, such as expense estimation, cost control, budgeting, and cash money circulation management for a certain task. Both sorts of bookkeeping are important, and they complement each various other. Building management accounting guarantees the company's economic health and wellness, while job monitoring audit makes sure the financial success of private projects.

All About Pvm Accounting

A crucial thinker is required, that will certainly deal with others to make choices within their locations of duty and to enhance upon the areas' job processes. The setting will certainly interact with state, university controller team, campus departmental personnel, and scholastic researchers. He or she is expected to be self-directed once the preliminary knowing contour relapses.

All about Pvm Accounting

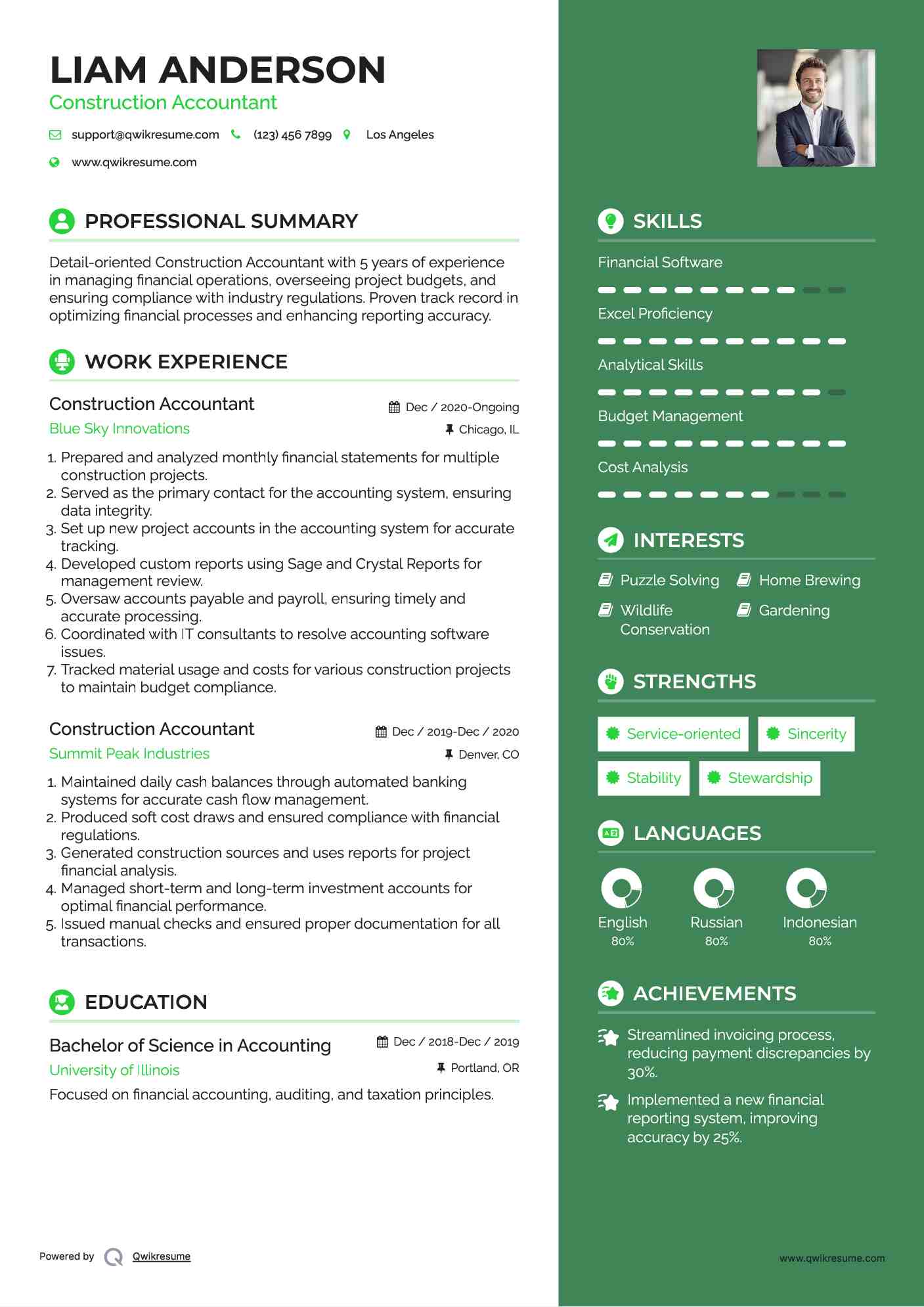

A Building and construction Accountant is liable for managing the monetary facets of building and construction projects, including budgeting, expense monitoring, economic reporting, and compliance with regulative needs. They work carefully with task supervisors, service providers, and stakeholders to guarantee exact financial records, expense controls, and prompt payments. Their knowledge in building bookkeeping concepts, task costing, and monetary evaluation is necessary for effective financial management within the building sector.

How Pvm Accounting can Save You Time, Stress, and Money.

As you've probably discovered now, tax obligations are an unpreventable component of doing service in the United States. While most emphasis normally pushes government and state revenue taxes, there's additionally a 3rd aspectpayroll taxes. Pay-roll taxes are tax obligations on a worker's gross salary. The incomes from pay-roll taxes are made use of to money public programs; thus, the funds gathered go straight to those programs as opposed to the Irs (INTERNAL REVENUE SERVICE).

Note that there is an extra 0.9% tax obligation for high-income earnersmarried taxpayers who make over $250,000 or solitary taxpayers making over $200,000. There is no company suit for this added tax. Federal Unemployment Tax Act (FUTA). Profits from this tax obligation go toward government and state joblessness funds to assist workers that have actually lost their tasks.

Facts About Pvm Accounting Uncovered

Your deposits must be made either on a regular monthly or semi-weekly schedulean political election you make before each schedule year (construction taxes). Month-to-month repayments - https://j182rvzpbx6.typeform.com/to/qpx4zyP8. A monthly repayment should be made by the 15th of the adhering to month.

So take treatment of your obligationsand your employeesby making total pay-roll tax settlements promptly. Collection and payment aren't your only tax responsibilities. You'll additionally need to report these quantities (and various other info) frequently to the internal revenue service. For FICA tax (as well as federal revenue tax obligation), you have to finish and submit Kind 941, Employer's Quarterly Federal Tax obligation Return.

About Pvm Accounting

States have their very own payroll tax obligations. Every state has its very own unemployment tax obligation (called SUTA or UI). This tax obligation price can differ not only by state yet within each state too. This is because your company's industry, years in organization and joblessness background can read this post here all determine the percent utilized to determine the quantity due.

Not known Facts About Pvm Accounting

Finally, the collection, compensation and coverage of state and local-level tax obligations depend upon the governments that levy the taxes. Each entity has its very own policies and methods. Clearly, the subject of pay-roll tax obligations involves plenty of relocating components and covers a vast array of accountancy expertise. A U.S.-based international certified public accountant can make use of experience in all of these locations when recommending you on your distinct company arrangement.

This site makes use of cookies to enhance your experience while you browse with the web site. Out of these cookies, the cookies that are categorized as necessary are stored on your internet browser as they are necessary for the working of fundamental capabilities of the web site. We additionally utilize third-party cookies that assist us examine and understand just how you use this site.

Report this page